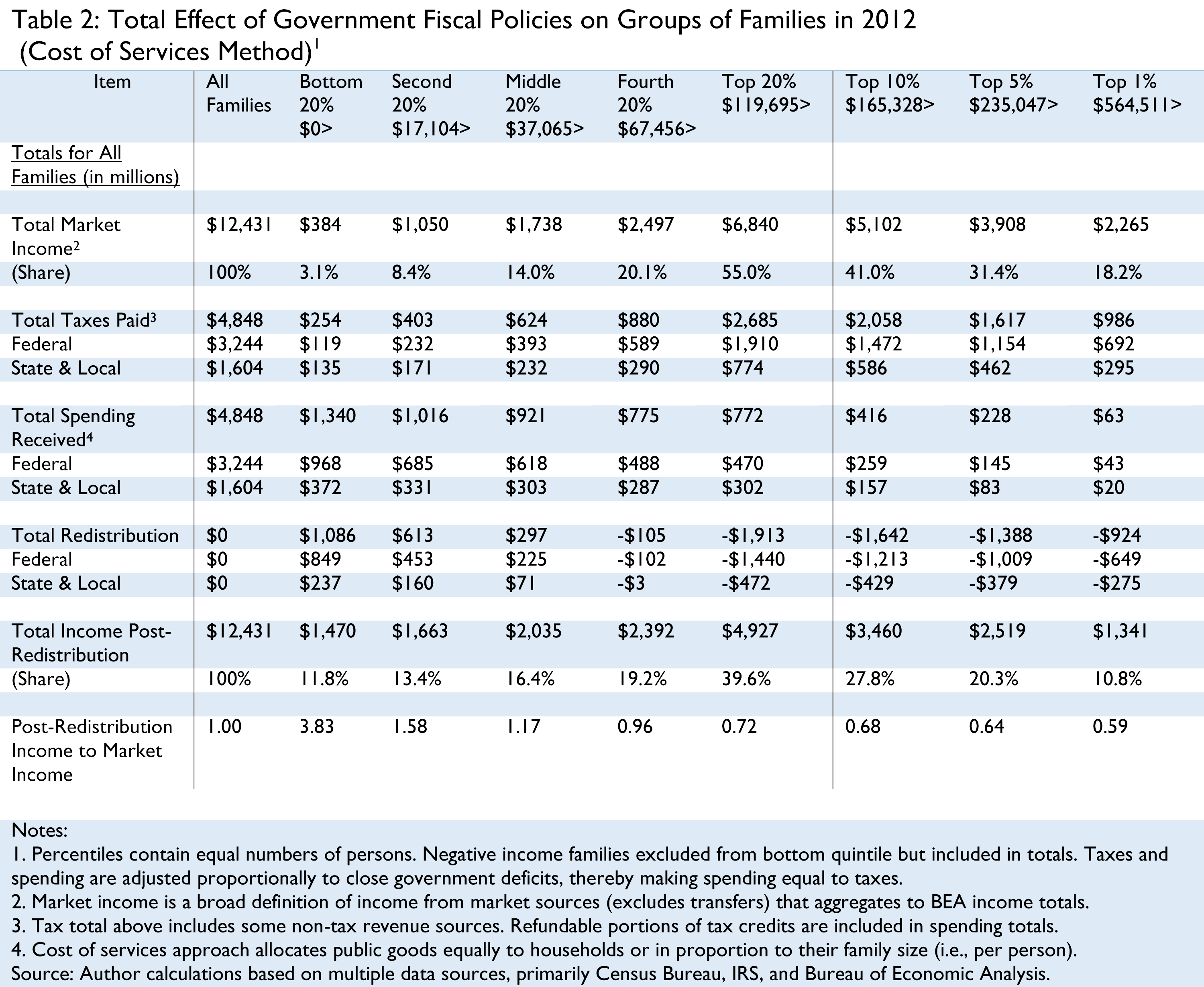

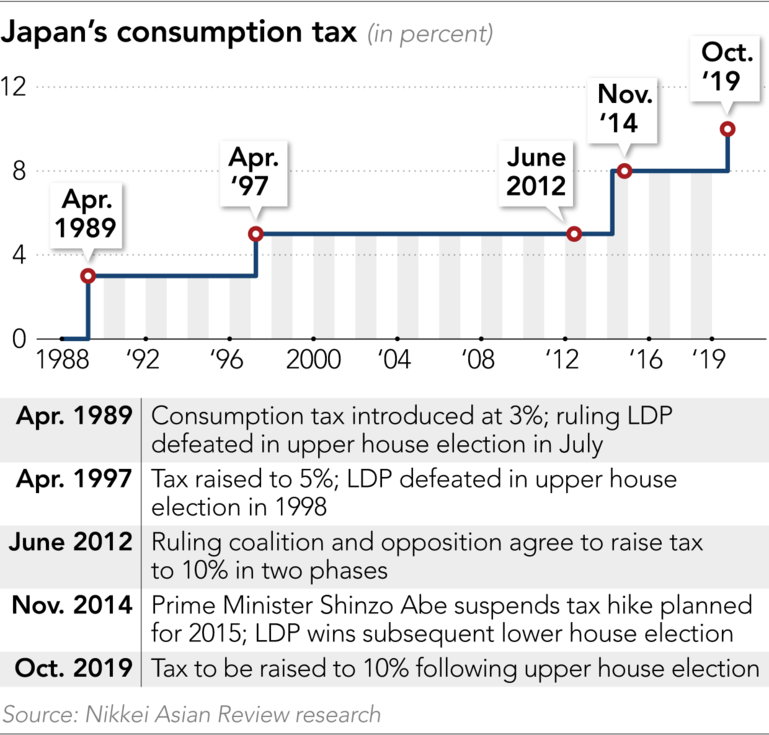

Has the redistributive effect of social transfers and taxes changed over time across countries? - Caminada - 2019 - International Social Security Review - Wiley Online Library

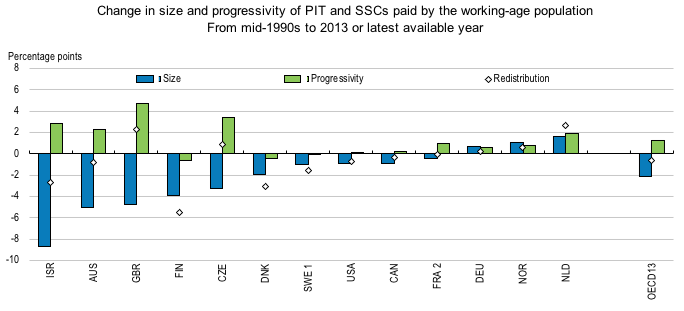

Income redistribution through taxes and transfers across OECD countries EU – Social Protection Reform Project, October 16 Rome Orsetta Causa, Senior. - ppt download

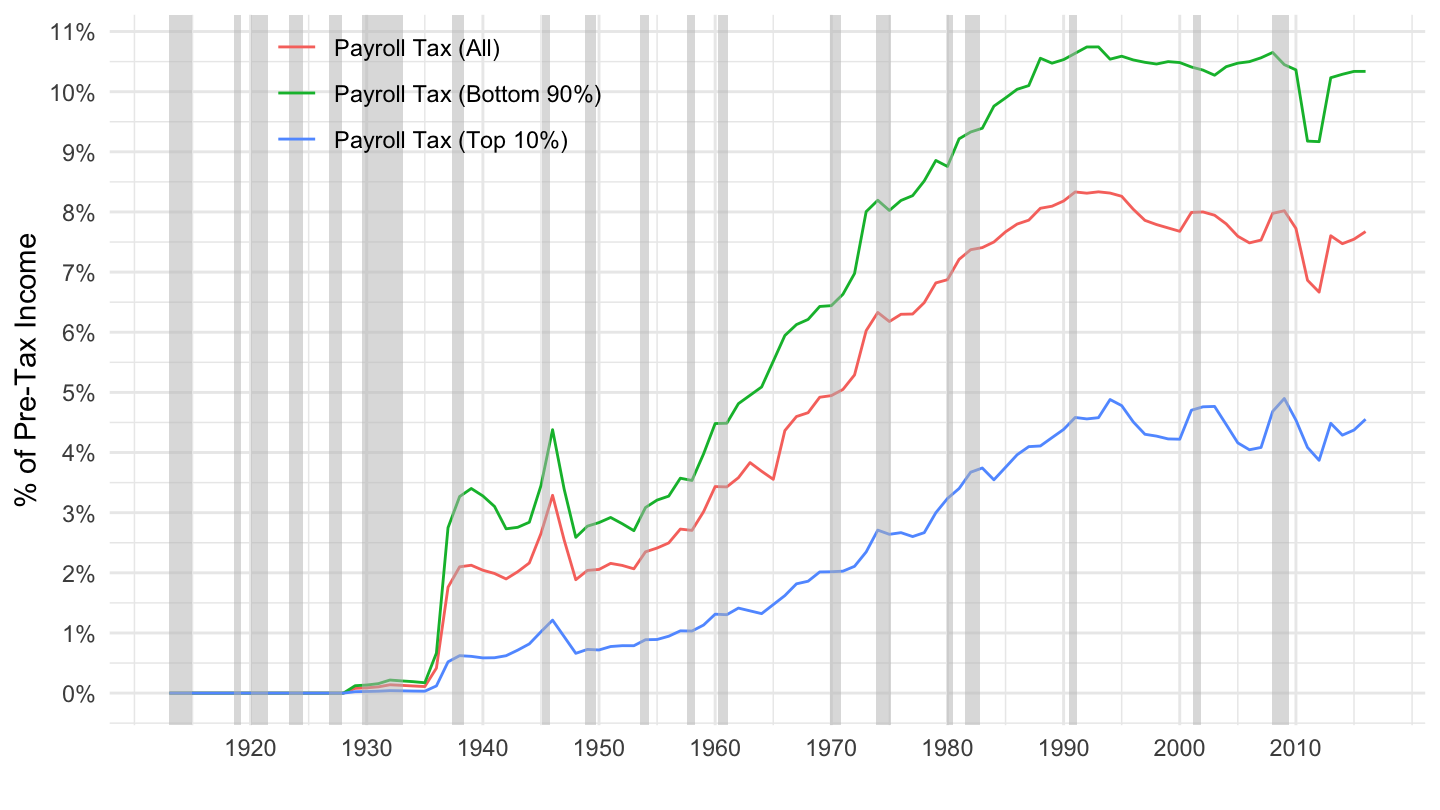

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014